- Connect Everything Newsletter

- Posts

- The XRP Correlation You Can’t Ignore (FLR 👀)

The XRP Correlation You Can’t Ignore (FLR 👀)

You’re going to want to see this…

Yesterday we shared ADA’s correlation and started eyeing a possible FLR pump.

Then @frankvalentich1 dropped a nugget: XRP’s correlation is even tighter showing a 3000% pump is imminent.

Naturally, we had to dig in… 👇

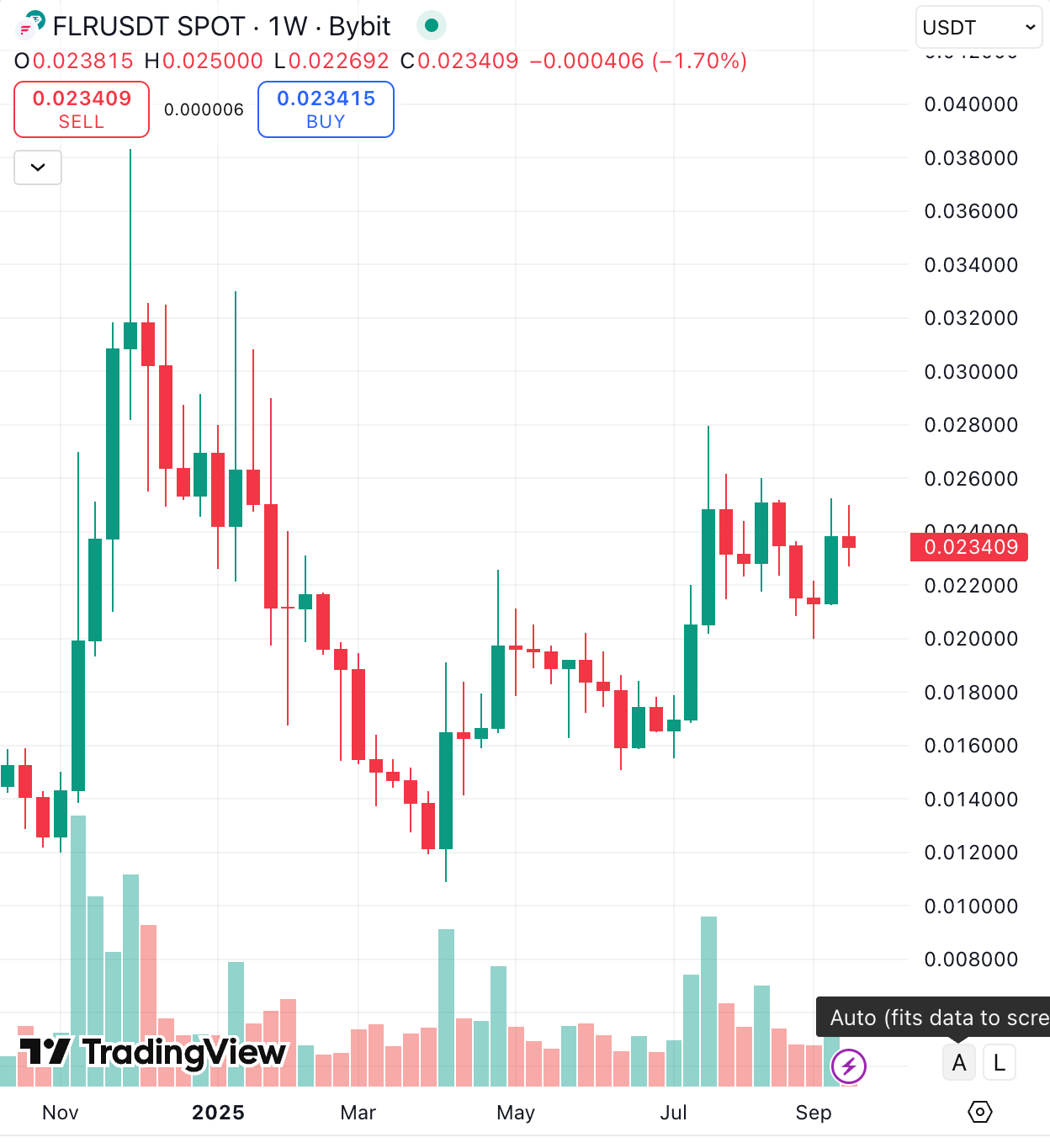

FLR (Flare) Current Weekly Chart

Big selloff, then a long consolidation phase.

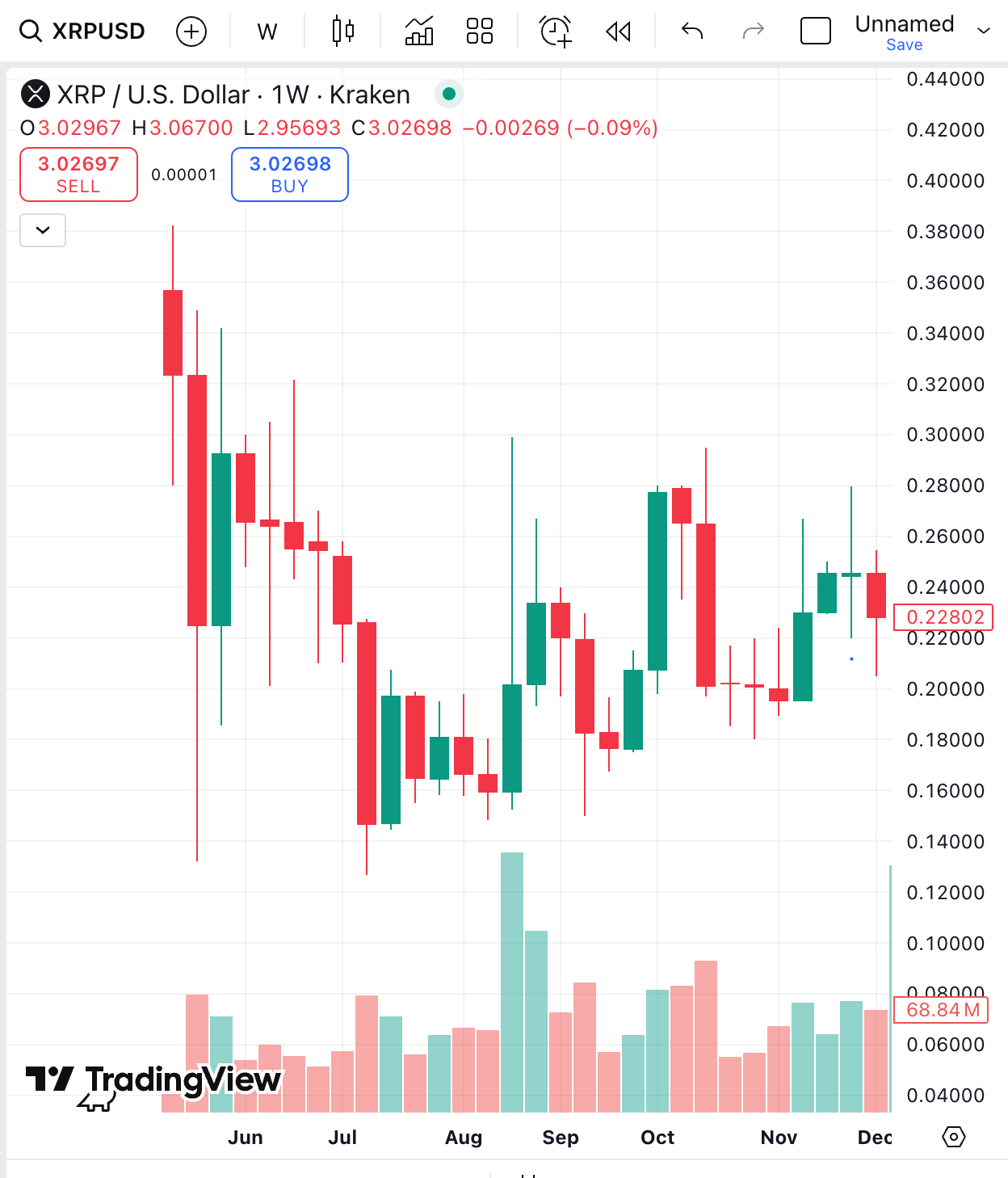

XRP Weekly Chart 2017 Bull Run Set Up

Similar structure: heavy initial dump → sideways consolidation → recovery attempt.

Like FLR, XRP was showing a rounded bottom attempt, with buyers stepping in after months of decline.

The shapes of the charts are strikingly similar:

Initial spike → sharp decline → sideways → recovery attempt.

Both show parallel accumulation ranges followed by attempts at higher highs.

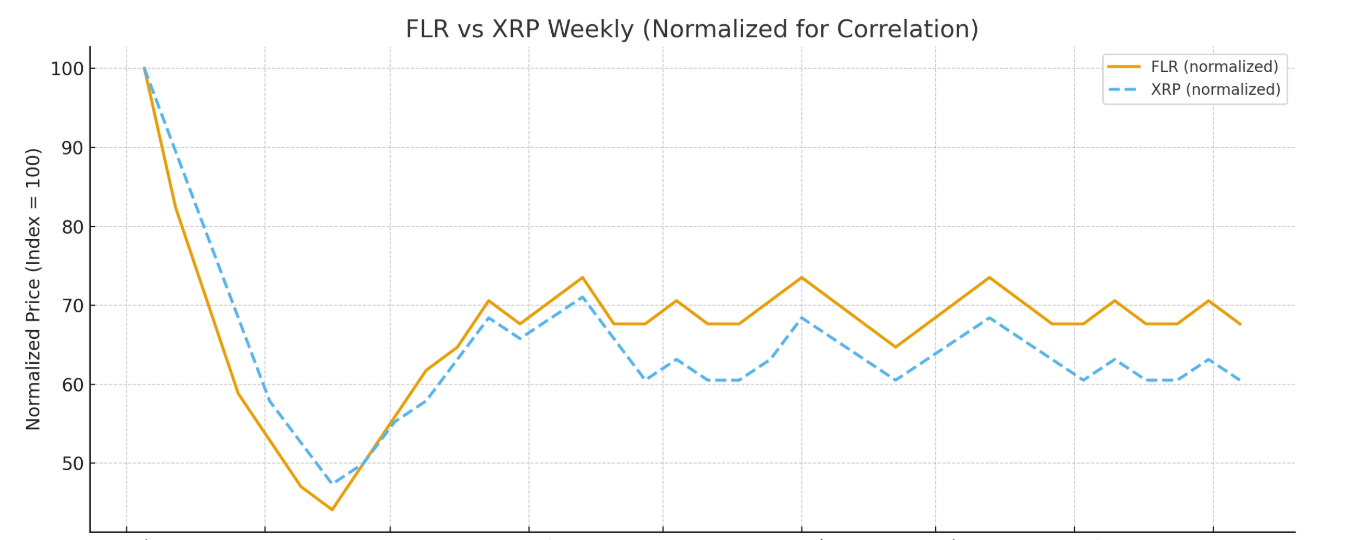

To really see the correlation we need to overlay the structures and apply a normalised price level for both assets.

Here’s the overlay:

Orange line = FLR (normalised)

Blue dashed line = XRP (normalised)

They’re almost identical!

Both charts show the same broad shape:

Early drop,

bottoming formation confirmed by higher lows,

Gradual recovery and sideways accumulation over several months,

Both holding steady near a consolidation band.

This visual confirms the correlation: FLR’s current price action tracks XRP’s 2017 structure closely, though FLR sometimes moves more sharply (higher volatility).

The correlation coefficient between FLR and XRP weekly closes is 0.87 🚀

That’s a very strong positive correlation (ranges from -1 to +1, where +1 is perfect lockstep).

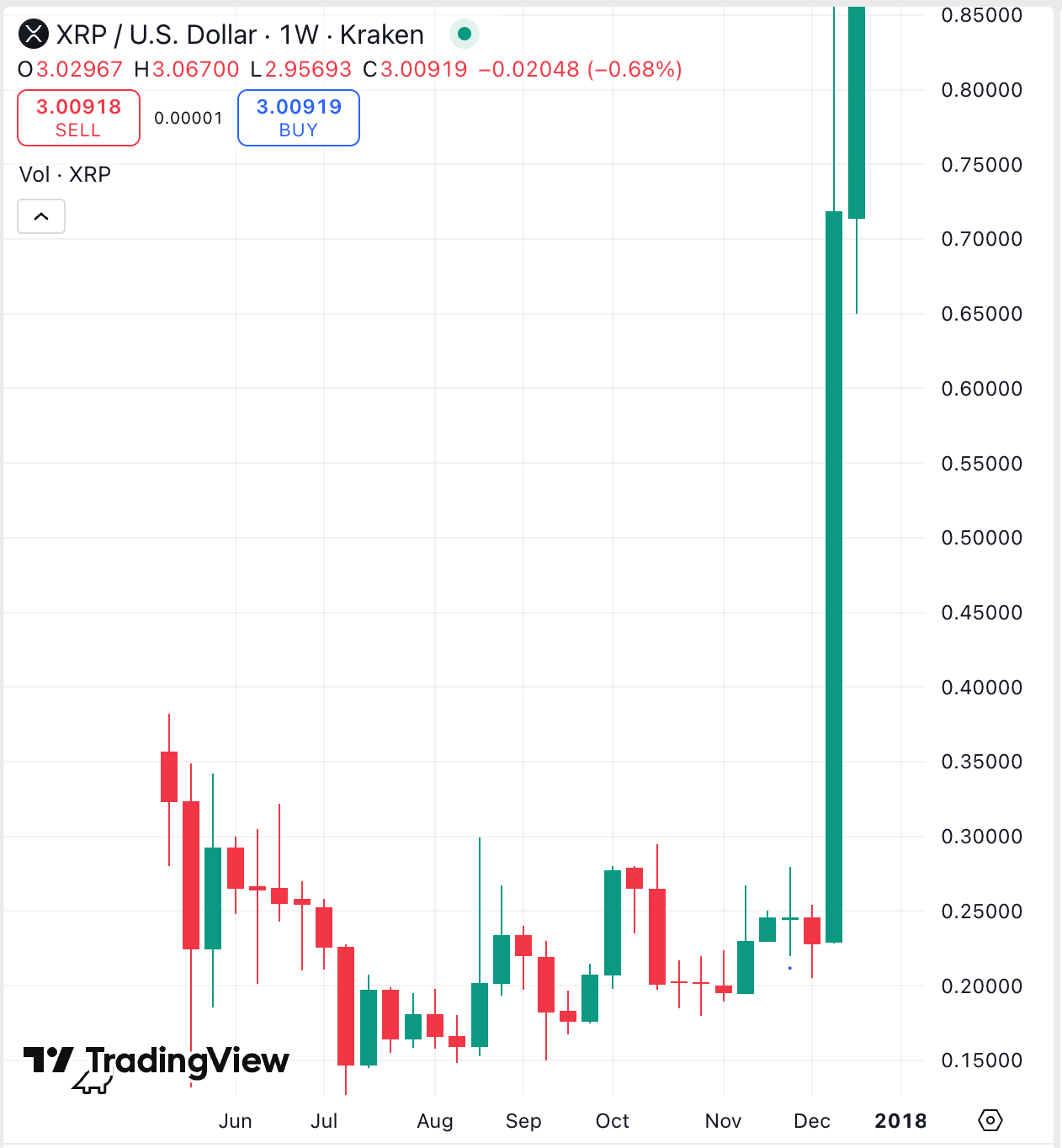

The next weekly candle XRP printed was legendary and started a 3000% pump👇

A similar pump for FLR would see $0.70 +

Exciting times as we look forward to Fassets launching and more major partnership announcements…

👊